What You're Looking At

This template shows a 20-year projection of cash flows for the SHIELD Enhanced Portfolio. The analysis demonstrates what we expect to happen each year based on multiple income streams working together.

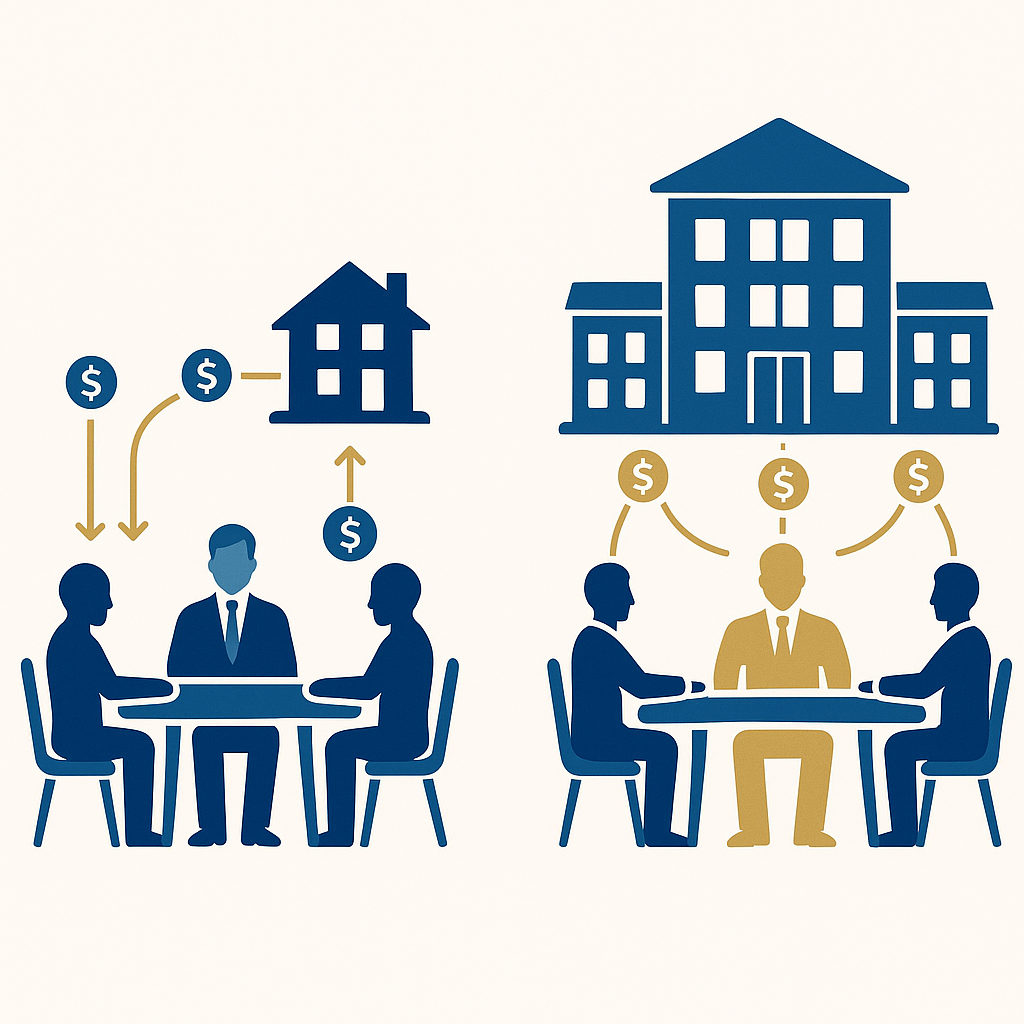

Diversified Income Streams

Fund Structure & Key Assumptions

Strategy Structure: $175M fund deploys $125M for life settlements ($500M face value), borrows $150M against settlements at par to fund housing authority loans at 4.5%, with $50M ARNEX reserve for non-correlated returns.

The Bottom Line

Multiple income streams working together target 14.6% returns over 20 years, with a 5-year exit option available for those who want liquidity sooner.

After fund management fees

20-year projection

Call option return

20-year cumulative